|

|

|

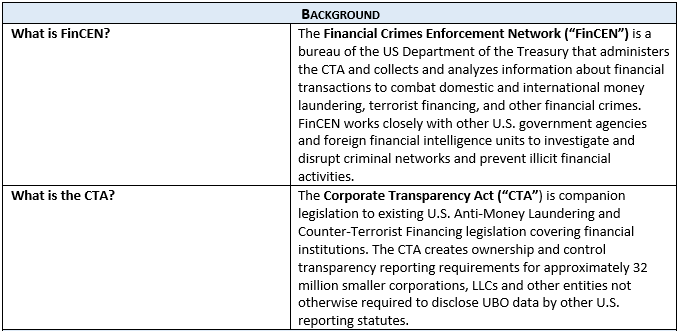

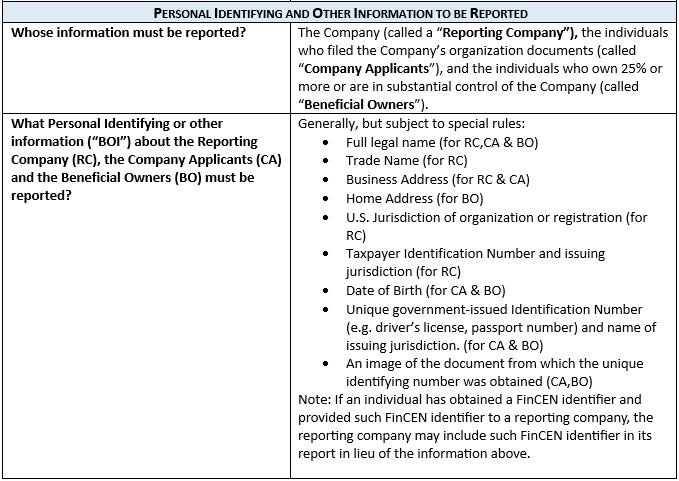

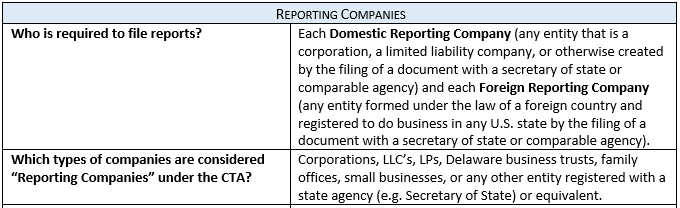

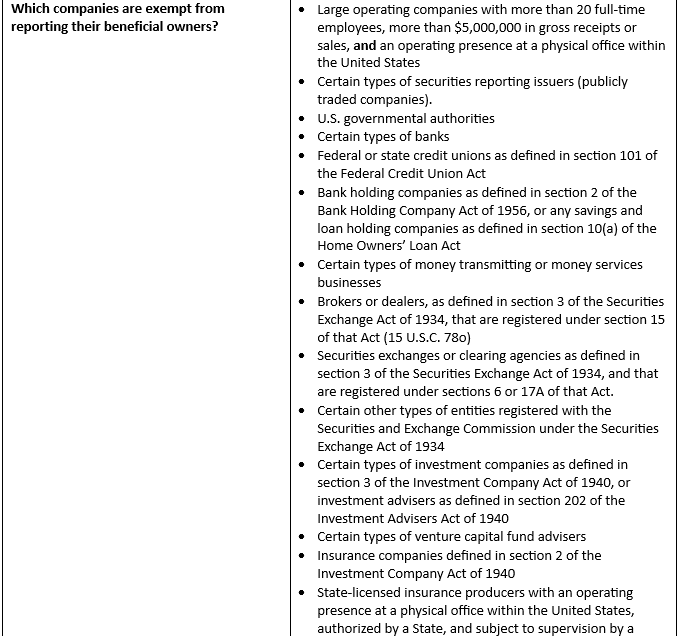

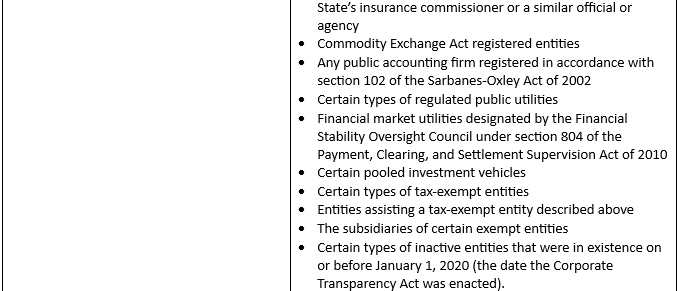

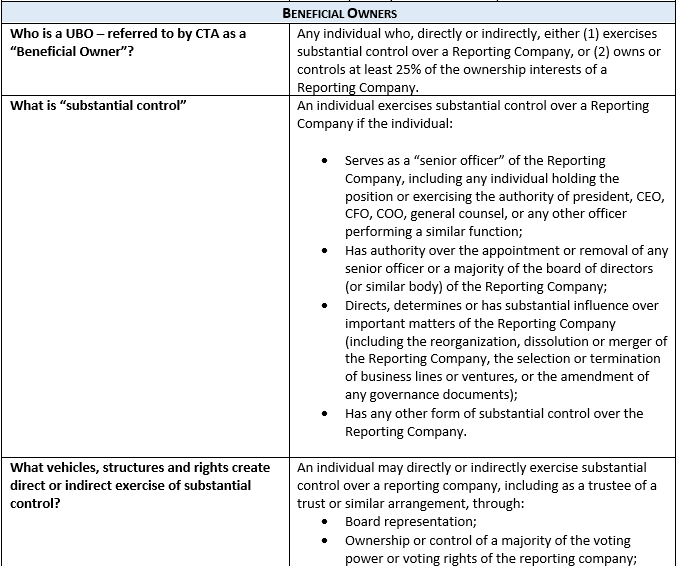

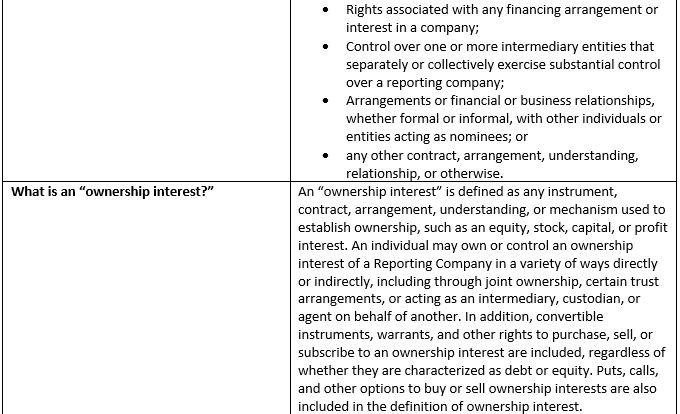

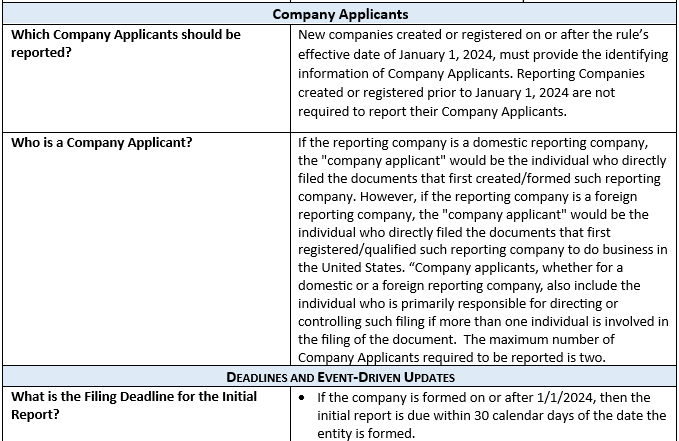

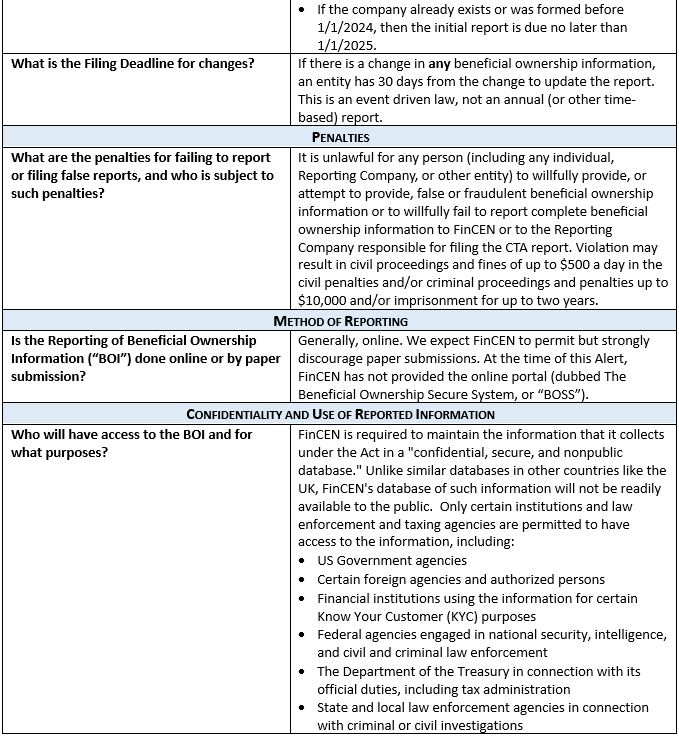

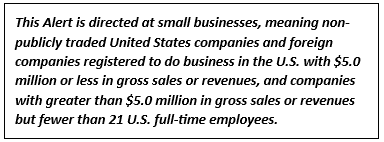

The CTA marks a sea change in the disclosure obligations of many small businesses. In this Alert, we will provide an overview of the CTA’s requirements in Q & A format. Mandatory Disclosure of Ultimate Beneficial Owners (UBOs). At least 30 countries have already implemented some form of central register of beneficial ownership information, and more than 100 countries have committed to implementing beneficial ownership transparency reforms. Under the CTA, Small Businesses with $5.0 million or less in gross sales or revenues, or those with greater than $5.0 million but fewer than 21 U.S. full-time employees, are required to report their UBOs’ personally identifiable information, similar to information required to obtain a driver’s license or passport, to FinCEN. The CTA defines a “beneficial owner” as any individual who, directly or indirectly, exercises substantial control over the reporting company or owns or controls at least 25 percent of the ownership interests in the reporting company. Reporting companies must go up the ownership chain until they reach the names of the covered individuals.

Strict Compliance Liability of Small Businesses, Senior Officers and Beneficial Owners. The CTA regulations require reporting companies not only to collect, but also to verify and certify that the reported information is “true, correct, and complete.” FinCEN has indicated that, as a general matter, it does not expect that an inadvertent mistake by a reporting company acting in good faith after diligent inquiry would constitute a willfully false or fraudulent violation. However, the regulations also provide that if a company does not report UBO information which is “true, correct, and complete,” the company and its senior officers will be deemed to have failed to report. This may result in civil proceedings and penalties up to $500 for each day the violation continues, as well as criminal proceedings and fines up to $10,000 and imprisonment up to 2 years. Failure to report may also cause an unwitting breach of compliance with law and disclosure representations, warranties and covenants in reporting company contracts. Some reporting companies may face significant resistance to disclosure from their beneficial owners, who may not be aware that they are also subject to these civil and criminal proceedings and consequences. |

|

|

|

|

|

|

|

|

|

|

This Client Alert is a summary published for the purpose of raising awareness. Consequently, it is not comprehensive but attempts to simplify complex and detailed subject matter. This Client Alert is not legal advice. If you have questions, please contact one of the authors, C. Russel Hansen, Jr. (rhansen@princelobel.com; 617-456-8036), John H. Chu (jchu@princelobel.com; 617-456-8007), or Jay Cho (jcho@princelobel.com; 617-456-8009). |

On January 1, 2021, Congress enacted the Corporate Transparency Act (“CTA”). The CTA is intended to prevent money laundering, terrorism financing, and tax evasion. It does so by requiring small businesses and their senior management to disclose personally identifiable information of their ultimate beneficial owners, senior officers, and directors to the Financial Crimes Enforcement Network (“FinCEN”) of the US Department of Treasury. The regulations also require direct or indirect beneficial owners to provide to the small business the ownership information necessary for the small business to report to FinCEN.

On January 1, 2021, Congress enacted the Corporate Transparency Act (“CTA”). The CTA is intended to prevent money laundering, terrorism financing, and tax evasion. It does so by requiring small businesses and their senior management to disclose personally identifiable information of their ultimate beneficial owners, senior officers, and directors to the Financial Crimes Enforcement Network (“FinCEN”) of the US Department of Treasury. The regulations also require direct or indirect beneficial owners to provide to the small business the ownership information necessary for the small business to report to FinCEN.